2023 Estate Planning Update

Di uno scrittore di uomini misteriosi

Descrizione

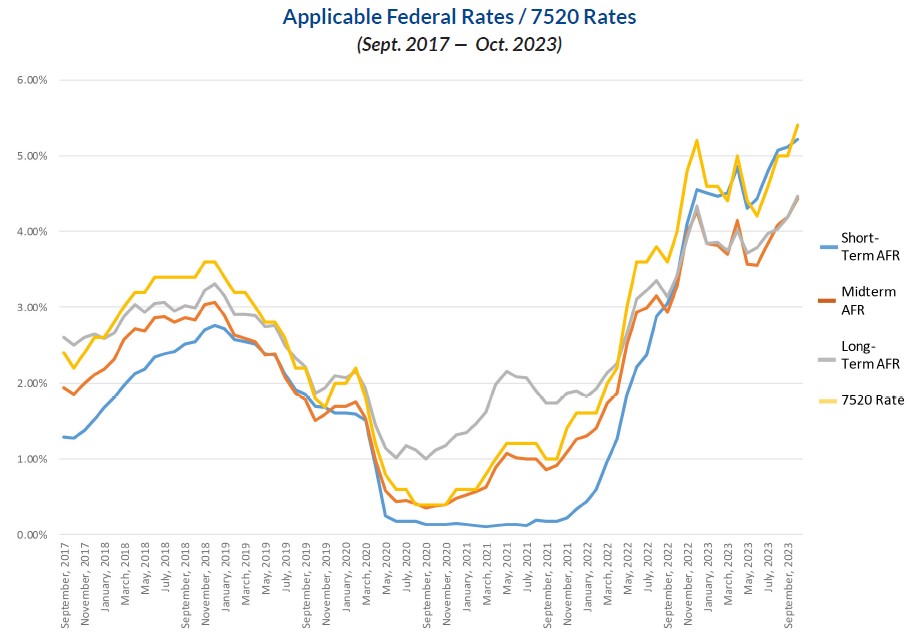

Estate Tax Update Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions The 2023 federal exemption against estate and gift taxes is $12,920,000 per person. This is an increase over the 2022 exemption, which was $12,060,000 per person (the increase reflects an inflation adjustment). The exemption is expected to drop by 50% at the end […]

The Game Plan Blog - Estate Planning & Medicaid Planning

Woods Oviatt hosts 2023 Estate Planning Update for bankers, accountants, and financial planners., Woods Oviatt Gilman LLP posted on the topic

Millennials and Estate Planning During a Time of Uncertainty

3 Important Estate Planning Updates 2023 — Perennial Estate Planning

September Tip: Update Your Estate Plan

LexisNexis Practice Guide: Connecticut Estate Planning

2023 Year-End Estate Planning Advisory

5 Reasons Why You Can't Afford to NOT Have an Estate Plan - The Heritage Law Center, LLC

Estate Planning Awareness Week: What's in My Digital Estate?

Why November is The Perfect Time for Estate Planning. - Shoffner & Associates

da

per adulto (il prezzo varia in base alle dimensioni del gruppo)